Energy Tax Credits Just Got a Huge Upgrade

Like many people, you probably skimmed or even completely ignored the Inflation Reduction Act signed into law last August. If you did, I don’t blame you. Like any legislation, it can be filled with complex language, obscure references, subsections, sub-subsections, footnotes, and amendments. Let’s be honest; it’s an absolute snoozefest.

After you wake up from your nap, be sure to read about the changes made to the Energy Efficient Home Improvement Credit as part of the act! Previously, you could receive a credit of 10% of the cost for replacing old windows and doors with energy-efficient ones. This credit was capped at a maximum of $500 over a lifetime.

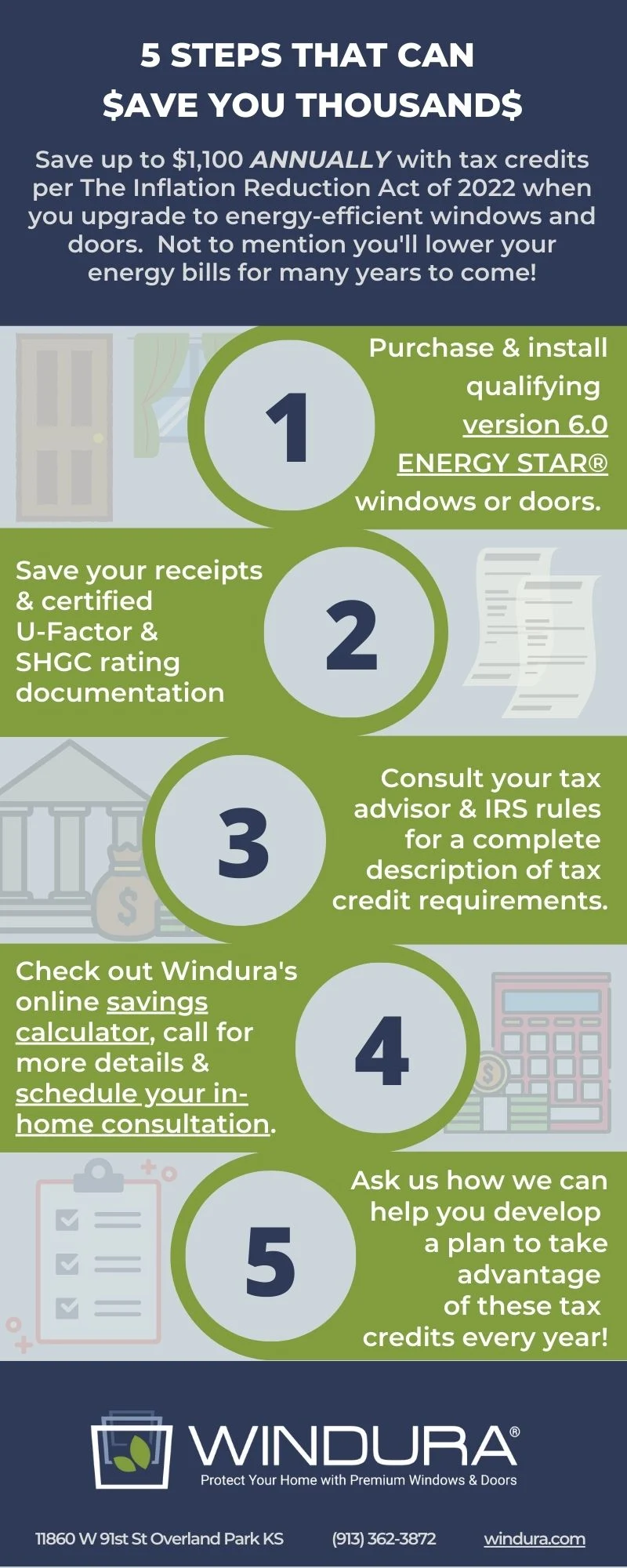

Now, the tax credit has been INCREASED TO 30% of the cost, with up to $600 per year for efficient windows and $500 for doors. Additionally, THE LIFETIME MAX HAS BEEN ELIMINATED, WHICH MEANS THE CREDIT CAN BE CLAIMED EACH YEAR! Over several years, that can add to significant savings totaling thousands of dollars!

Thoughtful planning to optimize your tax credits while gradually replacing the least efficient appliances in your home can significantly enhance your financial situation. Schedule a consultation today or call us at 913-362-3872 if you would like help making a plan. Calculate your potential credits by downloading our free Tax Credit Calculator.